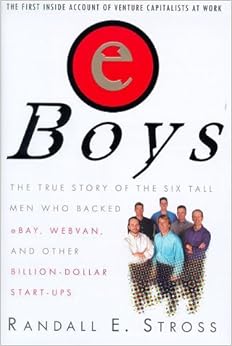

Free EBoys: The First Inside Account Of Venture Capitalists At Work Ebooks To Download

The first inside account of life within a Silicon Valley venture capital firm, eBoys is the fascinating true story of the six tall men who backed eBay, Webvan, and other billion-dollar start-ups that are transforming the Internet and setting a new pace for the economy.Randall Stross, author of acclaimed books on Microsoft and Steve Jobs, blends a business historian's perspective with a journalist's flair for suspenseful storytelling to look at wealth creation up close. For two years, Stross gained unprecedented access to the venture capitalists at Benchmark, an upstart firm founded by thirtysomething renegades whose average height happens to be 6´5´´. Since Benchmark's founding in 1995, each partner's net worth has increased, on average, $100 million annually. Stross was present as the Benchmark boys debated which businesses to support, and by recounting their conversations in testosterone-rich detail, he offers readers the most precise and enlightening account of the ways in which venture capitalists think, evaluate prospects, and wield influence.Stross also gained access to a number of the Benchmark-backed start-ups, including a small, privately held San Jose company called eBay. The value of the company grew from $20 million to more than $21 billion within two years of Benchmark's investment, an increase of 100,000 percent. Business Week called it "probably the best venture capital investment of all time."Venture capitalists have become iconic symbols of our time, just as investment bankers, investigative journalists, and hippies defined previous eras. In eBoys, Randall Stross has vividly captured the interplay of ambition, personality, experimentation, and risk, all acted out, larger than life, as the men of Benchmark and the entrepreneurs they back play their remarkable roles in the new world of Internet commerce and the creation of vast, sudden wealth.

Hardcover: 325 pages

Publisher: Crown Business; 1st edition (May 23, 2000)

Language: English

ISBN-10: 0812930959

ISBN-13: 978-0812930955

Product Dimensions: 9.6 x 6.5 x 1.2 inches

Shipping Weight: 1.4 pounds

Average Customer Review: 3.7 out of 5 stars See all reviews (67 customer reviews)

Best Sellers Rank: #608,813 in Books (See Top 100 in Books) #107 in Books > Business & Money > Finance > Corporate Finance > Venture Capital #1393 in Books > Business & Money > Biography & History > Company Profiles #4282 in Books > Business & Money > Small Business & Entrepreneurship > Entrepreneurship

eBoys reads like a Gospel tract for Benchmark Capital. I say this as someone who knows and likes "the boys" at Benchmark and can attest that their investment returns are genuinely top-tier. But unfortunately the author presents the Benchmark perspective to a fault, almost as if he's writing from inside some kind of reality distortion field. For starters, there is a major distortion in the Introduction about one of Benchmark's main competitors in the venture capital business, Kleiner Perkins Caufield & Byers. All other partners at this firm outside of John Doerr are disparaged as "not-Doerr," as if Doerr were the only competent venture capitalist at the firm that entrepreneurs want to work with and the rest of the partners are simply a weak supporting cast. This disparagement is anecdotally directed at KPCB partner Will Hearst in particular. I suppose this is done for dramatic effect, but it is way off. In recent years Will Hearst has been one of the top-performing partners at the firm, in some funds surpassing John Doerr. Meanwhile anyone who has been paying attention to the venture business in the least bit in recent years should know that KPCB partner Vinod Khosla, who was a cofounder of Sun Microsystems and is as much an entrepreneur as a venture capitalist, has been consistently hitting the ball out of the park, most recently with such multi-billion deals as Cerent and Siara. Not bad for a "not-Doerr" I would say. Another major distortion is the author's account of Benchmark's falling out with Stanford University.

Most people who want to found a new business dream about getting venture capital en route to going public. At least a third of these people who approach venture capital firms do not have any contacts to get them a hearing at venture capital firms. Even those who do will find the odds are long. Perhaps one deal in 100 from connected people will be funded by a particular venture capital firm.Almost all entrepreneurs I know think that venture capitalists get paid too much, and that they get in the way rather than being a help.This book will help you draw your own conclusions, as well as give you some ideas about what to look for if you do decide to go for venture capital.Many will be astonished to see that funded ideas often come with no workable CEO in place. The venture capitalist will often play a key role in doing the recruiting of the CEO and other key personnel.Also, others will be amazed to find out how important little things are to keeping deals together or tearing them apart -- usually the trust or lack of trust in those involved on all sides.For years, I have worked with executives whose firms were orginally funded by venture capitalists. I also have friends who are venture capitalists. Everything in the book rang true to me.The only thing that would have made the book bettter would have been equal access to the thinking of the people in the start-ups. We get their view through the VCs. Because of the relationships involved, that's hard to accomplish because there's a need to stay friendly that is harmful to candor.Although the book will be invaluable to entrepreneurs, it was not designed for that purpose.

eBoys: The First Inside Account of Venture Capitalists at Work The Startup Game: Inside the Partnership between Venture Capitalists and Entrepreneurs Venture Deals: Be Smarter Than Your Lawyer and Venture Capitalist Venture Capital Handbook: An Entrepreneur's Guide to Raising Venture Capital, Revised and Updated Edition Crowdfunding Success: The New Crowdfunding Revolution: How to raise Venture Capital for a Startup or fund any dream with a successful Crowdfunding Campaign ... Venture Capital, fundraising, , startup) The Associates: Four Capitalists Who Created California (Enterprise) THE ENTREPRENEURIAL BIBLE TO VENTURE CAPITAL: Inside Secrets from the Leaders in the Startup Game Deal Terms: The Finer Points of Venture Capital Deal Structures, Valuations, Term Sheets, Stock Options and Getting Deals Done (Inside the Minds) Biotechnology Venture Capital Valuations: Leading VCs on Deal Structures, Negotiations, and Best Practices for Current and Future Rounds of Financing (Inside the Minds) My Very First Library: My Very First Book of Colors, My Very First Book of Shapes, My Very First Book of Numbers, My Very First Books of Words 13 Hours: The Inside Account of What Really Happened In Benghazi Inside the Texas Chicken Ranch: The Definitive Account of the Best Little Whorehouse (Landmarks) Mars Rover Curiosity: An Inside Account from Curiosity's Chief Engineer The Diary of a Napoleonic Foot Soldier: A Unique Eyewitness Account of the Face of Battle from Inside the Ranks of Bonaparte's Grand Army Within Arm's Length: A Secret Service Agent's Definitive Inside Account of Protecting the President Making Work Work: The Positivity Solution for Any Work Environment First Things First: Understand Why So Often Our First Things Aren't First First In: An Insider's Account of How the CIA Spearheaded the War on Terror in Afghanistan Unknown Waters: A First-Hand Account of the Historic Under-ice Survey of the Siberian Continental Shelf by USS Queenfish (SSN-651) The Freedom Business: Including a Narrative of the Life & Adventures of Venture, a Native of Africa