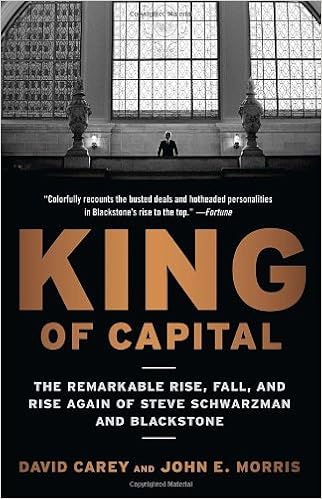

Free King Of Capital: The Remarkable Rise, Fall, And Rise Again Of Steve Schwarzman And Blackstone Ebooks To Download

Strippers and Flippers . . . or a New Positive Force Helping to Drive the Economy . . . The untold story of Steve Schwarzman and Blackstone, the financier and his financial powerhouse that avoided the self-destructive tendencies of Wall Street. David Carey and John Morris show how Blackstone (and other private equity firms) transformed themselves from gamblers, hostile-takeover artists, and ‘barbarians at the gate’ into disciplined, risk-conscious investors. The financial establishment—banks and investment bankers such as Citigroup, Bear Stearns, Lehman, UBS, Goldman Sachs, Merrill Lynch, Morgan Stanley—were the cowboys, recklessly assuming risks, leveraging up to astronomical levels and driving the economy to the brink of disaster. Blackstone is now ready to break out once again since it is sitting on billions of dollars that can be invested at a time when the market is starved for capital. The story of a financial revolution—the greatest untold success story on Wall Street: Not only have Blackstone and a small coterie of competitors wrested control of corporations around the globe, but they have emerged as a major force on Wall Street, challenging the likes of Goldman Sachs and Morgan Stanley for dominance. Great human interest story: How Blackstone went from two guys and a secretary to being one of Wall Street’s most powerful institutions, far outgrowing its much older rival KKR; and how Steve Schwarzman, with a pay packet one year of $398 million and $684 million from the Blackstone IPO, came to epitomize the spectacular new financial fortunes amassed in the 2000s. Controversial: Analyzes the controversies surrounding Blackstone and whether it and other private equity firms suck the lifeblood out of companies to enrich themselves—or whether they are a force that helps make the companies they own stronger and thereby better competitors. The story by two insiders with access: Insightful and hard-hitting, filled with never-before-revealed details about the workings of a heretofore secretive company that was the personal fiefdom of Schwarzman and Peter Peterson. Forward-looking: How Blackstone and private equity will drive the economy and provide a model for how financing will work.

Paperback: 400 pages

Publisher: Crown Business; Reprint edition (February 7, 2012)

Language: English

ISBN-10: 0307886026

ISBN-13: 978-0307886026

Product Dimensions: 5.2 x 0.9 x 8 inches

Shipping Weight: 3.2 ounces (View shipping rates and policies)

Average Customer Review: 4.5 out of 5 stars See all reviews (80 customer reviews)

Best Sellers Rank: #12,748 in Books (See Top 100 in Books) #1 in Books > Business & Money > Finance > Corporate Finance > Private Equity #7 in Books > Business & Money > Economics > Free Enterprise #16 in Books > Business & Money > Industries > Hospitality, Travel & Tourism

The story begins with the history of private equity. Stephen Schwarzman the ultimate central character in this book is a young mergers and acquisitions partner at Lehman Brothers. Henry Kravis of Kohlberg, Kravis and Roberts (KKR) is doing one of the first private equity buyouts called Houdaille Industries. It's a $380 million dollar deal. Schwarzman is sitting in his office at Lehman Brothers, and saying how could this be? How could KKR get this done? What are the details? It was a eureka type moment.Schwarzman orders up the financing document, and can't believe what he is reading. He is looking at a revolutionary financial concept that he never dreamed could exist. He knows that all great achievements start out as merely a thought, and then someone must act on the thought. KKR has already been in the business the better part of a decade when Schwarzman latches onto the concept.He tries to get Lehman Brothers to buy into the concept. They won't go, even though he explains that with one deal we could make more money than we make in a year doing everything else we do. Ultimately there is a falling out between glamour boy Pete Peterson who is running the firm with Lou Glucksman, the in your face trader who can't stand Peterson. Glucksman wins; Peterson leaves the firm and with Schwarzman and a secretary proceed over time to build Blackstone from nothing, just an idea. Together Schwarzman the young man, and Peterson the old tiger, they build Blackstone into a private equity powerhouse.It's all here, blemishes and all. You are reading financial history as firms collapse and private equity ascends.

For a while in 2006 it felt like private equity would buy up the universe. Intoxicated by rising pension allocations and a tidal wave of credit, PE companies acquired anything in their sight. The bonanza was crowned with the extravagant 60th birthday party of Blackstone's celebrity CEO Steve Schwarzman. Then came the hangover. Financial journalists David Carey and John Morris walk us through the making of Blackstone while at the same time giving the reader a history of the PE business.In a way this is a story much like many others about successful entrepreneurs with initial struggles and self-doubt before the business takes off, quick expansion and then the inevitable need for outside management additions, structure and procedures as the business matures and gets scale. Schwarzman really is a gifted competitor. By focusing on risks and not overreaching when others are exuberant, by keeping reserves to opportunistically invest when others are terrified, by diversifying his firm into often counter cyclical product lines and by being impressively flexible to changes in the environment that PE operates in, he has over the long time won by not losing. One by one most of the competitors over-invested in good times and had to scale down to their ambitions. In the end only the arch enemy KKR with Henry Kravitz at the helm stood between Blackstone and the domination of the PE-sector.One fascinating aspect of the two great PE booms (the LBO/corporate raider era of the late 80's and the period 2004 to mid-2007) that I - as a European - hadn't realized is how dependent they were on junk bond financing in the US.

King of Capital: The Remarkable Rise, Fall, and Rise Again of Steve Schwarzman and Blackstone That's Not How We Do It Here!: A Story about How Organizations Rise and Fall--and Can Rise Again Endgame: Bobby Fischer's Remarkable Rise and Fall-from America's Brightest Prodigy to the Edge of Madness Steve Jobs, Steve Wozniak, and the Personal Computer (Inventions and Discovery) Minecraft Diary: Wimpy Steve Book 7: Baffled and Bewitched! (Unofficial Minecraft Diary) (Minecraft diary books, Minecraft books for kids age 6 7 8 9-12, Wimpy Steve books 6 8, Minecraft adventures) Minecraft: Steve Adventures: The Wizard Of IZ (Steve's Comic Adventures Book 2) Diary of a Minecraft Steve 1: The Amazing Minecraft World Told by a Hero Minecraft Steve Minecraft Diary: Wimpy Steve Book 1: Trapped in Minecraft! (Unofficial Minecraft Diary) (Minecraft diary books, Minecraft books for kids age 6 7 8 9-12, ... adventures) (Minecraft Diary- Wimpy Steve) Minecraft Diary: Wimpy Steve Book 3: A Ruff Adventure! (Unofficial Minecraft Diary) (Minecraft diary books, Minecraft books for kids age 6 7 8 9-12, Wimpy ... series) (Minecraft Diary- Wimpy Steve) Minecraft Diary: Wimpy Steve Book 6: Minecraft Mysteries! (Unofficial Minecraft Diary) (Minecraft diary books, Minecraft books for kids age 6 7 8 9-12, ... adventures) (Minecraft Diary- Wimpy Steve) Minecraft Diary: Wimpy Steve Book 4: Lots of Ocelots! (Unofficial Minecraft Diary) (Minecraft diary books, Minecraft books for kids age 6 7 8 9-12, Wimpy ... series) (Minecraft Diary- Wimpy Steve) Creeper Revenge: Steve vs. Creeper: The Unofficial Minecraft Novel (Minecraft Steve's Adventures Book 1) Diary of a Minecraft Steve: Books 10 thru 12: (Unofficial Minecraft Book)(Minecraft Books,Minecraft Secrets,Minecraft Comics,Minecraft Diary,Minecraft ... (Diary of a Minecraft Steve Bundle Book 4) Minecraft: Steve Adventures: Jurassic Block (Steve's Comic Adventures Book 3) Minecraft: Steve the Noob 3 (An Unofficial Minecraft Book) (Minecraft Diary Steve the Noob Collection) When Genius Failed: The Rise and Fall of Long-Term Capital Management The Geography Bee Complete Preparation Handbook: 1,001 Questions & Answers to Help You Win Again and Again! Capital and Interest: A Critical History of Economic Theory & The Positive Theory of Capital (Two Books With Active Table of Contents) Venture Capital Handbook: An Entrepreneur's Guide to Raising Venture Capital, Revised and Updated Edition Creative Capital: Georges Doriot and the Birth of Venture Capital